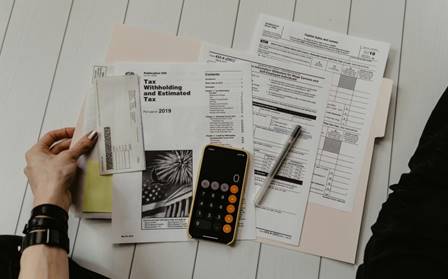

Budgeting is one of the foundational skills of personal finance. It’s the process of planning how to allocate your income to meet your financial goals while still covering your necessary expenses. Without a budget, it’s easy to lose track of where your money is going, which can lead to unnecessary debt or missed savings opportunities.

Why Budgeting is Important

Budgeting gives you control over your finances. It helps ensure that you’re not spending more than you earn, allows you to prioritize savings, and prevents the stress of living paycheck to paycheck. When done correctly, a budget is a tool for achieving your financial goals, whether that’s saving for a vacation, paying down debt, or building an emergency fund.

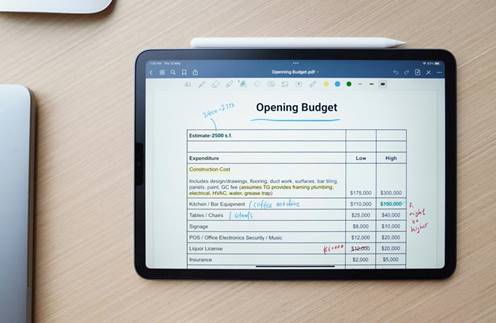

How to Create a Budget

Creating a budget is simpler than you might think. Here’s a step-by-step guide:

Track Your Income: Start by listing all sources of income, including your salary, side hustles, or passive income.

List Your Expenses: Categorize your monthly expenses into fixed (rent, utilities, car payments) and variable (groceries, entertainment, dining out).

Set Financial Goals: Decide what you want to accomplish with your budget—saving for a big purchase, paying off debt, or building an emergency fund.

Create Spending Limits: Based on your income and goals, assign a spending limit to each category. The 50/30/20 rule is a popular approach: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Track and Adjust: Regularly review your budget to ensure you’re staying on track and adjust it as needed.

A budget is a living document—it can be tweaked and adjusted as your financial situation changes.