Managing personal finances effectively requires smart decision-making, and R programming can help by providing powerful data analysis and visualization tools. Whether you’re tracking expenses, budgeting, or analyzing investments, R allows you to leverage data science for better financial planning.

How R Can Help in Personal Finance

✔ Expense Tracking & Budgeting – Use R to categorize spending and visualize trends with charts.

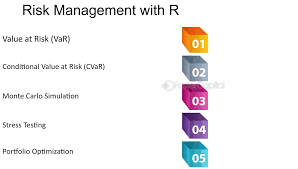

✔ Investment Analysis – Analyze stock market data, predict returns, and optimize portfolios.

✔ Retirement Planning – Model different saving scenarios and project future wealth.

✔ Debt Management – Calculate loan payments, interest rates, and payoff strategies.

✔ Financial Forecasting – Use statistical models to predict future income and expenses.

Why Use R for Financial Planning?

- Data-Driven Decisions – Gain deeper insights into your financial health.

- Custom Analysis – Build personalized finance models tailored to your goals.

- Automation – Streamline calculations and automate budgeting tasks.

- Free & Open-Source – No expensive software needed!

Get Started with R for Personal Finance

With libraries like tidyverse, quantmod, and ggplot2, R makes financial data analysis easy. Whether you’re a beginner or an expert, learning R can empower you to take control of your finances with data-driven insights.

Would you like a step-by-step guide on how to use R for budgeting or investment analysis? 📊💰